Please click "Continue" or you will be logged out.

Logging out

MOBILE DEPOSIT – Enroll today!

Depositing your check has never been easier! Simply snap a picture, fill in a few boxes and your check is on its way to your account. Sometimes this process can go wrong keeping you from completing your deposit, so here are some helpful tips to prevent your mobile deposit from being declined.

Mobile Deposit Tips:

Check must be properly endorsed. If your endorsement does not meet all of the below requirements, it will be rejected.

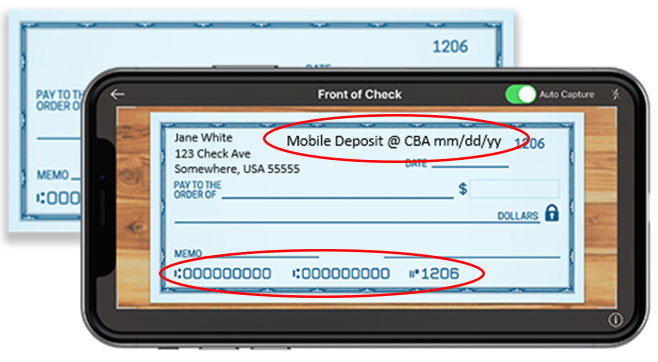

Front endorsement: “Mobile Deposit @ CBA on mm/dd/yy”

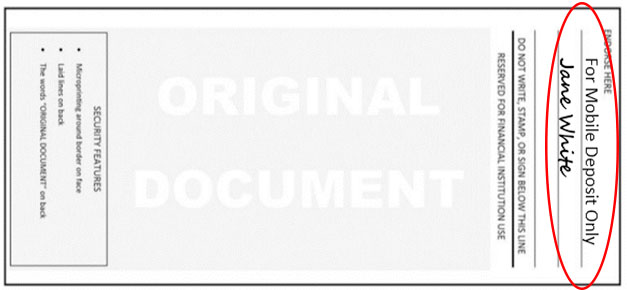

Back endorsement: “For Mobile Deposit Only” with signature endorsement

Ensure all of the information on the bottom of the check is legible and not cut off as shown above.

Lay the check on a flat dark surface when taking the picture and keep your hand steady so it is not blurry. Make sure the entire check (front and back) is in the photo.

Use a plain dark background to ensure the check is legible and stands out.

If your paycheck comes attached to a pay stub, remove the stub before snapping the picture.

Confirm your check status. Some checks get declined due to a poor photo or incorrect endorsement. If your check is declined, you may try again. If you are unsuccessful, please contact the bank for further instruction.

Up to $1,500.00 per check per day limit.

**Mobile Deposit Tips will pop up every time you open the deposit feature, however, if you dismiss the pop up; it will no longer appear. We do not recommend that you dismiss this pop up so you are reminded of these tips each time you use mobile deposit. **

Mobile Deposits are accepted throughout the day and are not automatically deposited. This may take up to 1 business day.

Funds Availability Policy: We may delay your ability to withdraw funds beyond the first business day.

Ineligible Checks and Items:

- Checks payable to any person or entity other than you, or to you and another party.

- Checks made payable to Citizens Bank.

- Checks made payable to a business without a business account titled in the name of the check.

- Checks containing alteration to any of the fields on the front of the check.

- Checks previously converted to a substitute check or remotely created checks.

- Checks drawn on a financial institution located outside the US or checks not payable in US currency.

- Checks dated more than 6 months prior to the date of deposit.

- Checks on which a stop payment order has been issued or for which there are insufficient funds.

- Checks prohibited by our current procedures relating to the Service or which are otherwise not acceptable under the terms of your Mobile Deposit Account.

**We do not accept loan payments through mobile deposit.**